From Hype to Reality: Where Web3 Is Heading in 2026

Table of Contents

Key Takeaways

- Real-world adoption is growing in finance, identity, gaming, supply chain, and media.

- Real-world assets, from property to equities, are being tokenized for global, liquid markets.

- NFTs shift from collectibles to authentication, ticketing, IP, and real estate assets.

- Institution-compliant DeFi markets emerge, bridging banks and blockchain systems.

- Multi-chain and modular blockchain systems enable scalable, enterprise-ready Web3 solutions.

The rise of Web3 has without a doubt been one of the most game-changing innovations of this decade, and its story is worth reading. It started out like just another buzzword, around cryptocurrency, but today it’s the foundational building block of our modern world economy. Sure the early days were all about the hype – DeFi booms, NFT craze, and endless new token launches, but fast forward to 2026 and the landscape looks a whole lot different.

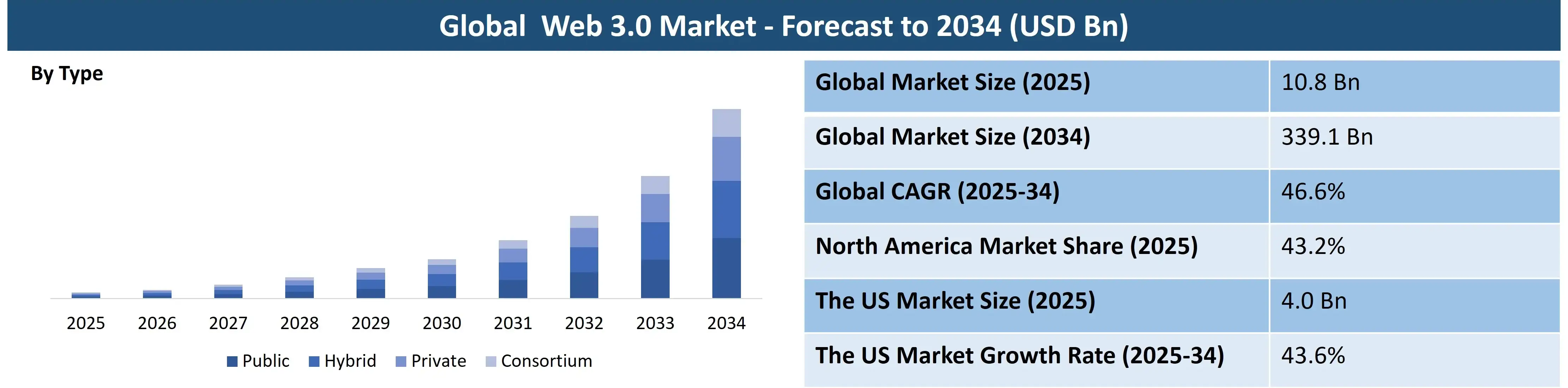

Web3 is now transitioning from a concept people get excited about, to a capability that really delivers, it is moving from wild experiments to actually being widely adopted, and from just a lot of hype to having real world utility to offer. It can be understood by the fact that the Web 3.0 market has already touched $10.8 billion, and is estimated to touch USD339 billion by 2034.

In this blog we’ll take a look at where Web3 is at now, which real-world applications are actually starting to catch on, and what’s waiting for us on the horizon in this next phase of the Web3 revolution.

What Exactly is Web 3.0?

Web 3.0 is the latest phase of the internet that represents its transformation from organizational controlled technology to a decentralized and user-controlled phenomenon, driven by blockchain, smart contracts, and play-to-earn models. Web 3.0 empowers users with digital property rights, decentralized identity, token-based economy, and transparent economic ecosystems.

However, this shift hasn’t been achieved in a day. Like any other transformative technology, early stages of web 3 faced volatility, skepticism, and regulatory pressure. But in 2026, the narrative is changing, from crypto trading to sustainable digital infrastructure.

Emerging Web3 Trends of 2026 Transforming Global Digital Markets

Mainstream Tokenization

One of the biggest transformations in 2026 is the rise of real-world asset (RWA) tokenization. Institutions and bussinesses are no longer doubting tokenization, rather they’re implementing it. Tokenized assets now include, real estate and land ownership rights, company equity and shares, precious metals and commodities, bonds and treasuries, and luxury goods and collectible assets. Tokenization unlocks faster settlement, fractional ownership, and global liquidity enabling anyone to invest in asset classes once reserved for the privileged few.

Web3-Native Identity Systems Are Replacing Login Models

Traditional email-password systems are outdated. Decentralized identity (DID) frameworks and soul-bound tokens are gaining acceptance in various fields, such as, healthcare records access, banking and KYC processes, travel and digital passports, workforce certifications and resumes, and university degree verification.

Web3 identity does not try to replace institutions, it strengthens them by mitigating data frauds.

DeFi Transforms Into Regulated Digital Finance

Decentralized Finance (DeFi) has started to move beyond experimental yield farming and meme tokens. Today’s DeFi landscape comprises of, institution-compliant lending markets, decentralized trading backed by custodial bridges, on-chain treasury markets, automated asset management tools, and tokenized savings and insurance models.

Regulations, which were once seen as a threat, have become a catalyst for trust and innovation. Banks, fintechs, and Web3 protocols are now collaborating with each other instead of competing.

Interoperability & Modular Blockchain Infrastructure

The future is not one blockchain, it is multi-chain networks working as one.

Cross-chain bridges, layer-2 rollups, and applicative blockchains enable, quicker scaling, secure communication between blockchains, industry-specific blockchain ecosystems, and plug-and-play blockchain components.

By 2026, Web3 won’t be a single platform, it will be a web of networks driving financial systems, supply chains, entertainment, and commerce, with innovation.

Reasons for Web3.0’s Growth

Here are the keys driving forces behind web 3’s growth:

- Clearer Regulatory Frameworks: Governments around the globe understand the web 3.0 in a more clearer way, which is helping them creating rules that are promoting innovation, and also ensuring consumer protection at the same time.

- Enterprise-grade Blockchain Adoption: Businesses in finance, retail, logistics, healthcare, and manufacturing sectors are integrating blockchain into main stream processes.

- Increasing Digital Ownership: One of the most important reason behind web 3’s growth is that users now demand control over data, identity, and assets, web3 provides the infrastructure for this digital ownership.

- Technical Maturity: Technical maturity is increasing, that is helping address scalability issues, gas fees, and user experience gaps rapidly, paving the way for mass adoption.

What Web3 Will Look Like In 2026?

- Web 2 .0 and Web 3.0 Coexisting: Traditional platforms are integrating decentralized features. For instance, pure Web 2.0 platforms are focusing on user sovereignty and data protection.

- Main streaming of Metaverse: Play-to-earn model has become play-and-earn, NFTs are integrating into major gaming ecosystems, and virtual identity is becoming mainstream.

- Web 3 based Payments: Traditional banks are supporting crypto wallets, stablecoins are turning into a global cross-border payment standard.

- Decentralized public infrastructure: One of the biggest Developments in the web3 that can be seen in 2026 is Voting, identity, and records move on-chain as governments adopt Web3 rails.

Build Web 3.0 For Tomorrow With Delta6Labs

Delta6Labs Fintech, which is pioneer in providing cutting-edge Web3 solutions is playing a critical role in making the Web3 vision a reality by providing, blockchain development and integration, token creation and smart contract services, Web3 consulting and architecture planning, DAO frameworks and decentralized economy design, and Cross-chain and security-focused infrastructure.

With our expertise in building Web3, we empower businesses, enterprises, and institutions to transition from Web2 models to Web 3.0 based decentralized digital ecosystems.

Final Thoughts

From the above blog, one thing has become clear that Web3 is no longer an experiment, it is becoming the foundation of digital innovation. While the early days were dominated by hype, speculation, and volatility, 2026 marks a maturing era driven by, real-world adoption, institutional collaboration, tokenized economies, identity and ownership rights, and transparent and programmable finance.

According to the trends and developments in the web 3, the next evolution of the internet will not be about technology, it’s about digital empowerment, economic freedom, and trust built into systems.

As we look forward, one truth stands clear, Web3 is not substituting the internet, it is transforming it, and we at Delta6Labs are at forefront to build modern day web 3.0 solutions, that will help business and institutions to adopt decentralized ecosystems along with the traditional systems.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.