A Detailed Guide To Start A Cryptocurrency Exchange

Table of Contents

What is Crypto Exchange?

Crypto exchange platform is a medium which facilitates the users to trade in various crypto currencies like traditional stock exchanges. We are familiar with the Wolf Street and Bombay stocks exchange which are the famous platforms for stocks exchange, similarly for crypto currencies we have famous exchanges like Binance, Bybit and OKX. But after the fallout of FTX, which is among the leading crypto exchange platforms, it has become important to understand about these platforms in details before investing money.

Types of Crypto Exchange Platforms

Crypto exchange platforms can be further classified as centralized, Hybrid and decentralized platforms:

Centralized Crypto Exchange Platforms

Centralized cryptocurrency exchanges are regulated platforms that facilitate cryptocurrency buying, selling, and trading. They act as an intermediary to provide a safe and secure way to connect users to each other and to exchange fiat and cryptocurrencies. Here is the list of some centralized crypto exchange platforms.

- BitDelta

- Coinbase

- Kraken.

- Binance

- Bitfinex

Decentralized Crypto Exchange Platforms

Like centralized exchanges, these platforms do not act as intermediaries and also, they don’t require the users to deposit their assets to exchange cryptocurrency. These platforms are peer to peer marketplaces facilitating the trading of cryptocurrencies. Here is the list of some decentralized crypto exchanges:

- Raydium

- Orca

- Aftermath Finance

- Meteora

- Pancake Swap

Hybrid Crypto Exchange Platforms

Crypto exchange platforms which provide features and facilities of both centralized and decentralized platform are considered as Hybrid crypto exchange platforms.

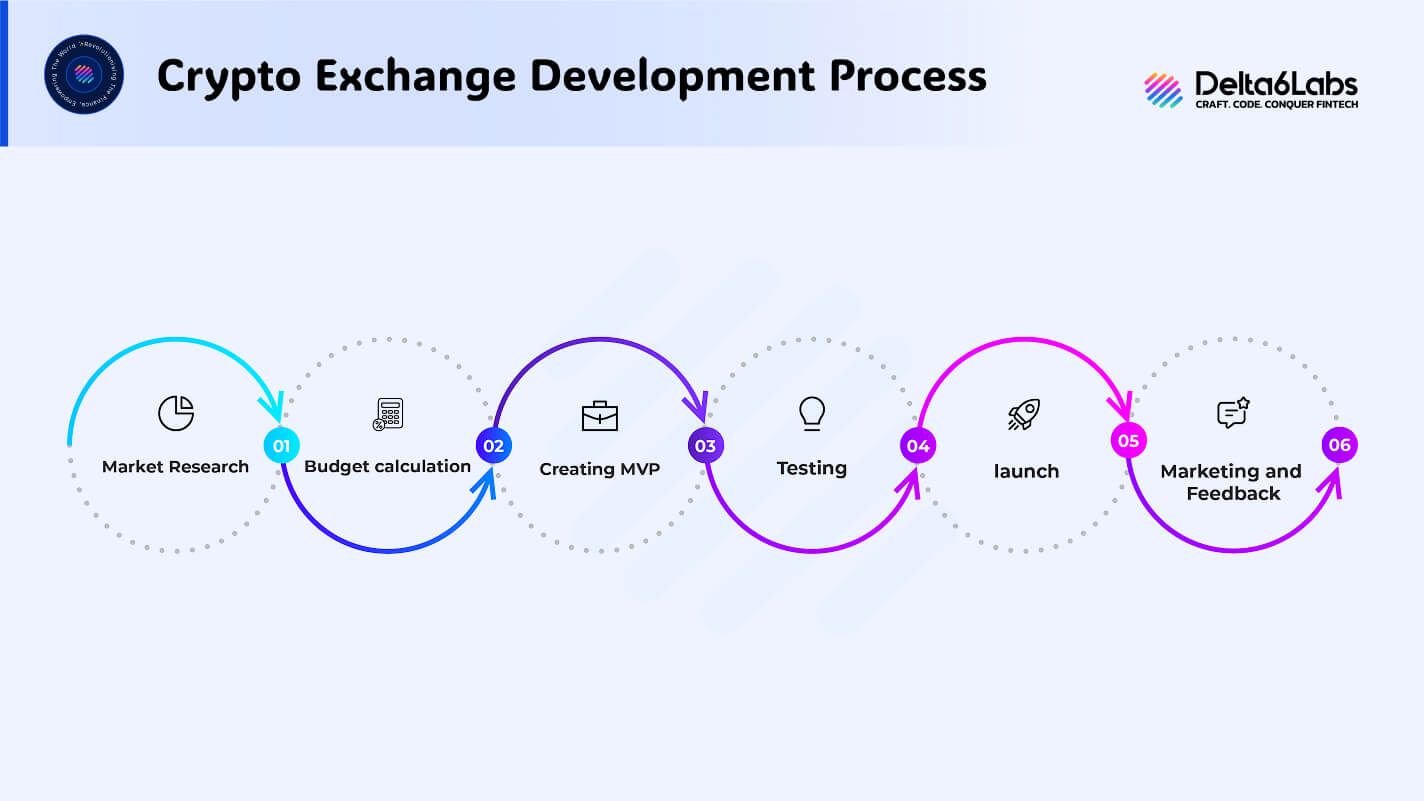

Steps to Build a Crypto Exchange

Market Research

The foremost step to build a crypto exchange should be conducting intensive market research and develop an understanding of market trends and customer needs.

Budget Calculation

Without a proper budget and expense calculation the risk of revenue loss is very high. The budget calculation includes the infrastructure development and the team building which includes designers, developers, research team and support staff. People do not want to be short on funds before they launch the company.

Creating Wireframes, Prototypes and MVP

The next useful step is to design wireframes, prototypes, and MVP (minimum viable product). This will help the developers understand what people want from your exchange and how they use it. Once you have the right design and functionality for your exchange, you can start working on the product.

Testing

Usability testing is an integral part of building a crypto exchange because it allows us to check whether it is providing the desired results or not and if there is something that needs to be replaced or redesigned before the final launch of the product.

Exchange Development and Launch

As soon as the testing is complete and the changes are done as required, the developing team can start the final process of exchange development. The backend team should complete the coding process so that when the product is ready, it can be launched.

Marketing and Feedback

One of most important part of exchange development is proper marketing and advertisement of the product. The multi-directional promotion of the product on social media can help the company to grow with a desired pace. Along with the marketing, the consumer’s feedback is also very important. It helps the company in course correction and to build a better platform. For example, the main reason for the rise of Delta6Labs as a top software development company is their marketing team and quick response to consumer feedback.

Challenges in Crypto Exchange Development

Software development is not an easy process. Like other platforms, the crypto exchange development also has some challenges like:

Security

Security is a critical challenge to the crypto exchange platform because of the potential risk of cyber-attack on the digital assets. To protect the consumer’s details and assets the crypto exchange should be equipped with high security tools. Exchanges are frequently targeted by hackers who attempt various attacks, including phishing, hacking, and ransomware. Protecting user funds and data from these threats requires implementing sophisticated security measures.

Liquidity Management

Liquidity management can turn out to be a critical challenge for the exchange. To provide users access to buy and sell assets at a good price, a sufficient amount of liquidity is mandatory. The risk of volatility is very high in absence of proper liquidity. The exchanges need to make sure that they provide enough liquidity to operate the transactions smoothly.

User Interface and Design

If the user interface and design is not good or confusing then it would not be appreciated by the consumer who may get frustrated by the experience. That’s why it is very important to make their design user-friendly and a simple but attractive interface.

Regulatory Compliance

The world of cryptocurrency is comparably new as compared to the traditional currency exchanges. To understand the regulatory compliance is very important. For example, adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations is required yet difficult. Ensuring complete and precise compliance increases operational difficulties. Due to the ever-changing legal environment, P2P exchanges are continuously vulnerable to new restrictions or prohibitions, which have an influence on their operations and user confidence.

If these challenges are managed well then, the chances of building a successful crypto exchange are high. The Users can take consultation from fintech software development companies like Delta6Labs to overcome these challenges. Here is a list of some famous and successful crypto exchange platforms.

The above list includes the giants of the crypto exchange market and their market size . And the credit for their success go to their experienced team and open to suggestion consumer services. If any company adhere to these conditions then the dream of making a successful crypto exchange platform is more real than you think. In this highly changing and growing market, cryptocurrency is a game changer and to generate wealth in upcoming years, investing in digital currency will play an important role.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.