Crypto Trading Pairs Explained: How to Read and How These Work?

Table of Contents

With increasing trading activities, it is vital to understand the basic yet important aspects of cryptocurrency trading. Trading pairs are one such key aspect of crypto trading. In traditional stocks and equity trading, trading pairs are also highly significant, but in cryptocurrency trading, their importance increases because the crypto market is highly volatile, and price changes within the blink of an eye. It becomes necessary to choose such trading pairs that can bring yield to the trader in both market conditions, bullish and bearish. In this blog, we will discuss the role of crypto trading pairs in the virtual asset world and how they can help build trading strategies to maximize profits.

What are Crypto Trading Pairs?

In cryptocurrency trading, a crypto trading pair is a pair of cryptocurrencies that represent the exchange rate between them, indicating how many units of one cryptocurrency are required to purchase one unit of another cryptocurrency. For example, BTC/ETH is a popular trading pair in the crypto trading market that represents how many Ethereum (ETH) a trader will get for one Bitcoin (BTC).

These pairs help traders speculate on the price movements, make informed trading decisions, and mitigate risks. Traders can make their strategies and maximize their profits in both bullish and bearish market trends. Crypto trading pairs help traders in determining price value and liquidity in the market. Different trading pairs have different trading fees and slippage. Understanding trading pairs can help traders in risk management and provide them with a competitive edge over others.

Types of Crypto Trading Pairs

There are two major types of trading pairs:

Crypto-cross Pairs

In crypto-cross pairs, both currencies are digital currencies, such as Bitcoin and Ethereum, Ethereum and Ripple, and Bitcoin and Ripple. These types of crypto trading pairs are used mainly by seasoned traders because they understand the cryptocurrency market better than novice traders.

Fiat-to-crypto Pairs

These types of crypto trading pairs are more popular among new traders who do not understand the complexity of the crypto market. In fiat-to-crypto trading pairs, one fiat currency is used to buy cryptocurrency. For example, USD/XRP tells how many XRP a trader can buy for one USD.

Understanding Base Currencies and Counter/Quote Currencies

Base currency and counter currency are two of the most discussed terms in the cryptocurrency trading market. These terms help understand and read trading pairs, which can allow traders to make informed decisions and effectively manage potential risks. Virtual currencies in a crypto trading pair are often represented by three letters, such as AAA/BBB.

Base Currencies

The first currency that is represented in the trading pairs is called the base currency. It represents the asset a trader is buying or selling (a trader buys one unit of a base currency). Any cryptocurrency or fiat currency can be considered a base currency, such as BTC, ETH, or XRP. The base currency always serves as a reference against which other cryptocurrencies are calculated.

Counter/Quote Currencies

Quote currencies in crypto trading pairs are the currencies that traders pay or receive in exchange for the base currencies. They are always represented second in the trading pairs. A quote currency also represents the amount needed to buy one unit of base currency.

How Do Crypto Trading Pairs Work?

Crypto trading pairs allow traders to buy one cryptocurrency in exchange for another. For example, the BTC/XRP pair is priced at 10,000; it means that one Bitcoin can be exchanged for 10,000 units of XRP.

Here is a step-by-step process explaining the working of crypto trading pairs in a crypto exchange:

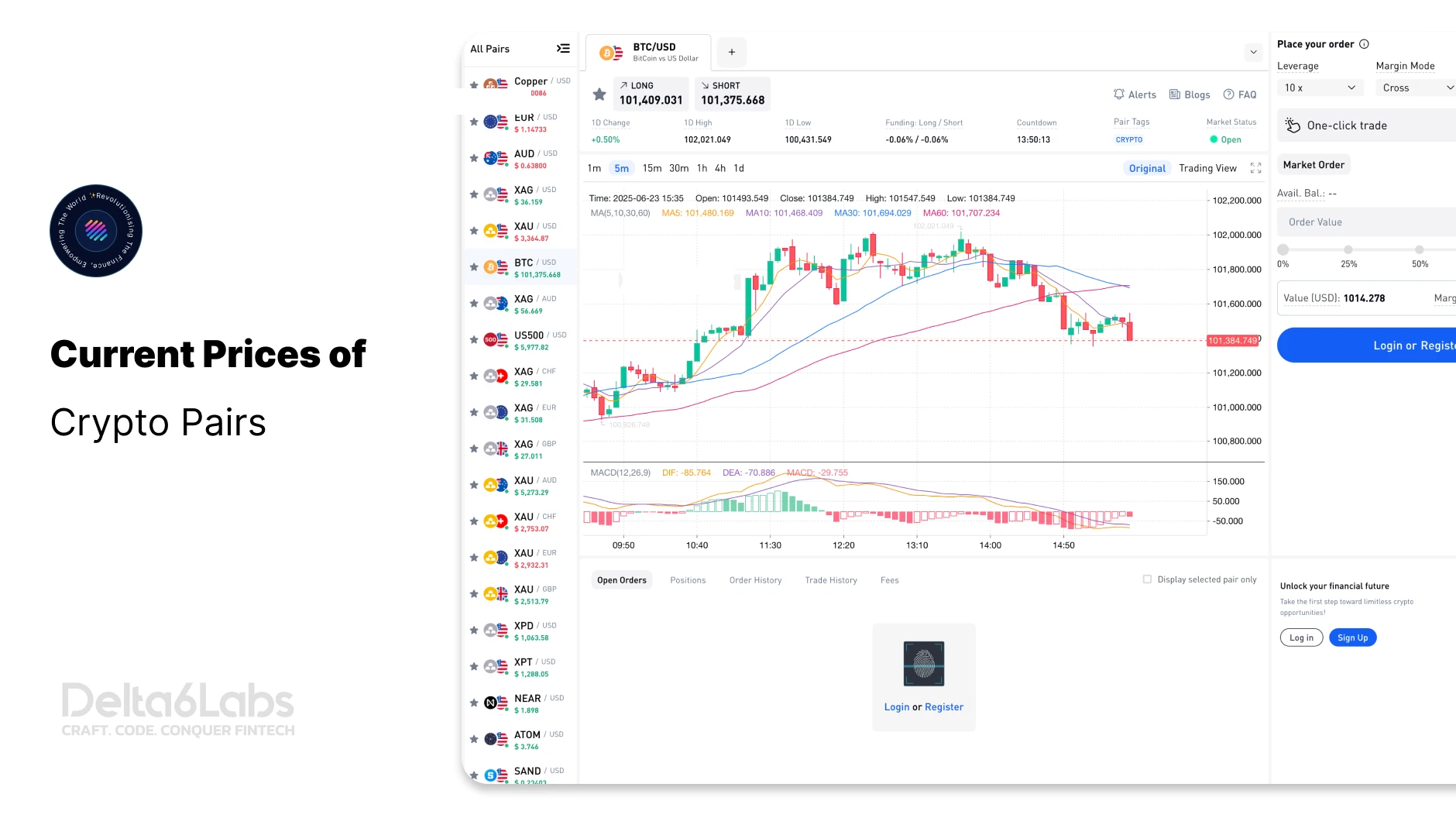

- The foremost step is to choose a trading pair from the list of trading pairs listed on the crypto exchange, such as BTC/ETH, BTC/USDT, and ETH/USDT.

- The next step is to check the current exchange rate for your selected trading pair. For example, BTC/USDT represents the number of USDT a trader can get for one BTC.

- The last and most important step is to execute the trade and exchange your base currency against the quote currency.

If a trader understands the workings of trading pairs, it will be helpful for them to make wise decisions and yield maximum returns. People often use high-liquidity trading pairs, such as BTC/ETH, BTC/USDT, and ETH/USDT. High liquidity means people can execute trades quickly with minimal slippage. Another crucial thing traders need to understand is that the exchange rate of crypto trading pairs can differ for different crypto exchanges.

Crypto Trading Pairs with Stablecoins

This is another type of trading pair that is getting popular among traders. Major cryptocurrency exchanges, including Binance and KuCoin, enable traders to execute trades using stablecoins. Fiat-based stablecoins are the most popular and provide high iquidity to traders. USDT (Tether), USDC (USD Coin), and BUSD (Binance USD) are among the most popular stablecoins among traders. BTC/USDT, ADA/USDC, and ETH/BUSD are examples of crypto-stablecoin trading pairs.

Traders can calculate the value of cryptocurrencies in fiat currencies easily with the help of stablecoins, as the top three stablecoins in terms of market capitalization are pegged to USD.

Bottom Lines

One cannot deny the importance of understanding the concept of trading pairs in the cryptocurrency market. It can help traders make informed decisions and mitigate the risks associated with the high volatility and price fluctuations in crypto trading. Trading pairs represent the exchange rate at which one cryptocurrency can be bought with another cryptocurrency. It can differ for different crypto exchanges.

There are two significant types of trading pairs: Fiat-to-crypto and Crypto-cross pairs. There is another type of crypto trading pair, which is also very popular among users, the crypto-stablecoin pair.

Traders often choose trading pairs that have high liquidity and low slippage, so that the trade can execute immediately without facing any loss due to price fluctuation. Crypto exchanges list trading pairs as per their choice, and it can be different in various crypto exchanges like Binance, Visiion and Zenit World, etc.

If you are looking for the market insights about crypto trading pairs, then Delta6Labs can help you.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.