Crypto Intent Prediction Marketplaces: Everything You Need To Know

Table of Contents

What are Crypto Intent Prediction Marketplaces?

To better understand this, we must deduce the meaning of intent-based predictions. In layman’s terms, intent means what people are doing and what they can do in the future. Based on this intent, predictions are made to suggest in which direction the market is going.

Crypto Intent Prediction Marketplaces are platforms where people predict the market’s mood before investing and generate revenue through predictions. In these marketplaces, data is collected through different channels like social media activities, such as analysing a sudden spike in tweets about a specific coin or company and understanding why. Search engine queries are also a great source of information about the market trends. These marketplaces have made the lives of investors easier by feeding them market data analyzed by machine tools so that they can invest according to the trends with fewer risks.

The Significance of Crypto Intent Prediction Marketplaces

The size of the global crypto market is very big. Still, the market remains highly volatile because of the investment patterns of the traders. Many investors face huge losses due to investing without considering the market trends. That’s where the intent prediction plays an important role. Using data from multiple sources to predict the market pattern before investing in any cryptocurrency. These marketplaces have proved themselves to be a boon for trading companies because they feed accurate data and market insights to the companies, which helps them trade with more precision and fewer risks.

How do Crypto Intent Prediction Marketplace work?

Data Collection

These marketplaces collect data from multiple sources across the internet and store it in a decentralized repository.

Data Analysis

The data collected from multiple sources across the internet is analyzed with the help of machine learning tools and artificial intelligence. Sophisticated algorithms are used to analyse the patterns and anomalies within the data. Later, these anomalies and patterns are used to predict the mood of the market.

Prediction

Based on the analysis done by the machine learning tools on the collected data, crypto intent prediction marketplaces predict the movements of investors and traders.

User Interaction

With the help of these marketplaces, investors and traders decide their moves and make less risky decisions. Users can also bet on predictions and can earn rewards. These marketplaces are helping traders and investors make informed decisions by feeding them customized data.

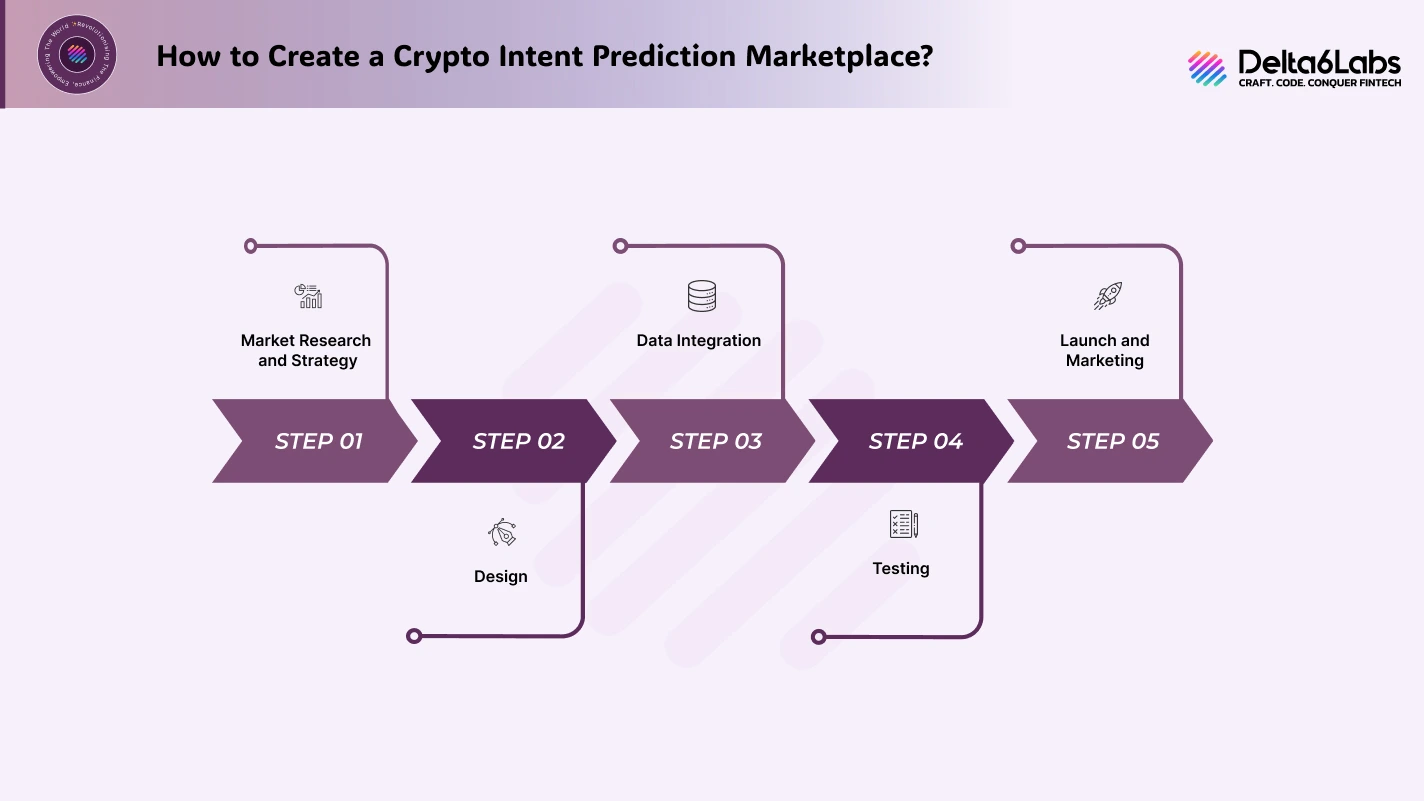

How to Build a Crypto Intent Prediction Marketplace?

Earlier in this blog, we understood the process of these marketplaces. But it is even more important to know how these marketplaces are developed. The development process of these marketplaces consists of the following steps:

Market Research and Strategy

The foremost step for developing a content intent marketplace is to conduct thorough market research and understand the needs of traders, investors and businesses. It is also mandatory to understand the movement of competitors and design a robust strategy accordingly.

Design

With the help of data scientists and designers, create a visually attractive platform that is easy to navigate and supports both new and seasoned traders. A platform can be as good as its design is, that’s why this step is very critical for the development of these marketplaces.

Data Integration

Data integration is the soul of crypto intent prediction marketplaces. Contacts should be established with the data providers to fetch data from different sources like social media, search engines and blockchain networks. APIs can also be developed to collect data from different sources on the internet.

Testing

After the data is integrated, intensive and rigorous testing is conducted to test the design, efficiency, accuracy and security of the platform. In case of errors and bugs are found, necessary steps are taken to correct them.

Launch and Marketing

The final step is launching the marketplace. The launch should be followed by intensive marketing of the platform on social media as well as in offline mode. With the right marketing strategy, traders and investors will be attracted towards the platform.

Benefits of Crypto Intent Prediction Marketplace

Risk Management

The crypto market is highly volatile, but at the same time, the revenue-generating potential is also very high. Investment and risk complement each other, and it is considered that without risk, the chances of generating high revenues are also less. But these marketplaces have changed this thought process. With their informed and data-backed predictions, crypto intent prediction marketplaces have made it possible to invest with minimum risk. These marketplaces can also relocate your digital assets in case of any market downtrend.

Real-time Analysis

These marketplaces collect real-time data from internet sources like social media platforms such as Reddit and X (Earlier known as Twitter), search engine queries and other browsing platforms. With the help of machine learning tools, the market sentiments and patterns are analyzed to forecast the movement of traders. This real-time analysis helps the users to invest in different cryptocurrencies according to the market sentiment.

Time Efficient

Earlier, users had to spend a lot of time conducting research and collecting data from different sources. These marketplaces have brought down the research and analysis time by feeding analyzed data to the users. Crypto intent prediction marketplaces also empower their users by providing them with market insights and predictions through a central dashboard.

Transparency

Crypto intent prediction marketplaces are decentralized and operate on blockchain technology. Blockchain technology stores data on a network and can be accessed by authorized persons having private keys. The data stored on the blockchain is immutable and cannot be altered without changing data in the other blocks of the network. Hence, crypto intent prediction marketplaces allow their users to fetch data that is transparent and secure.

Competitive Edge

Comparative to the traditional research and analysis, Data and forecasts provided by crypto intent prediction marketplaces are more intensive, classified and better analyzed with the help of machine learning and artificial intelligence. This gives users an edge over others who have scattered data. A competitive edge can help investors unleash a high revenue potential.

Role of ML and AI in Crypto Intent Prediction Marketplaces

Machine learning tools and artificial intelligence have proved their immense potential and worth in the prediction marketplace landscape. As per different surveys and research on the subject, data scientists have figured out that these tools can analyse all the non-linear and noisy data available from multiple sources on the internet in a very small timeframe and understand the patterns that cannot be easily figured out manually. Machine learning tools have become a mandatory part of prediction marketplaces in cryptocurrency scenarios because of their highly dynamic and volatile nature.

Various machine learning tools like support vector regression (SVR) and Gaussian regression Poisson (GRP) models, random forests (RF), regression trees (RT) and the k-nearest neighbours (kNN) algorithm are used to deduce the data from the Internet and to map the non-linear data for further analysis.

Random forests are formed by combining the regression trees and classification trees. Regression RFs are used for forecasting future returns, and classification RFs are used to predict whether the prices of a specific coin will increase or decrease on a particular day.

Artificial intelligence methods comprise feedforward neural networks (FFNN), Bayesian regularisation networks (BRNN), and radial basis function networks (RBFNN). These tools analyse the data and predict the patterns of investors, provide a competitive edge to the users, and also minimise the risk. With the help of these AI tools, crypto intent prediction marketplaces select the trading algorithms of investors and select strategies as per the data fed by ML tools. Generally, the software solution used for this purpose is called an algo-wheel. Algo-wheel predicts the future trading patterns of investors by analysing the history, performance and strategies of the investors.

Role of Smart Contracts and Blockchain Technology

Crypto intent prediction marketplaces are decentralized platforms that operate on blockchain technology. Blockchain technology provides better transparency and security to the data collected by these marketplaces. Smart contracts are the backbone of every decentralized application that operates on blockchain technology. Smart contracts reduce human interference and the role of intermediaries. Integration of smart contracts enables automatic handling of payouts and predictions without any intermediaries. Smart contracts improve the efficiency of these marketplaces because smart contracts are programmed to run themselves automatically as soon as the predetermined conditions are met. Smart contracts and blockchain technology have paved the way to develop robust and advanced crypto intent prediction marketplaces.

Scope of Crypto Intent Prediction Marketplaces

Prediction marketplaces have a very bright future ahead because the markets are turning volatile and dynamic. The global market size of prediction markets was valued at 17 billion in 2024 and is projected to grow by a CAGR of 23% and to reach approximately 90 billion USD. Prediction markets are not limited to the banking and finance industry; they are valuable in various sectors like healthcare, telecom, life sciences, retail, and energy. In the projected growth for prediction marketplaces, BFSI holds the major portion, which includes the cryptocurrency sector as well. The crypto market is highly volatile and dynamic, and investing by minimising the risk is very important to yield high revenues. That’s why these marketplaces are a boon to investors and traders.

Conclusion

Crypto intent prediction marketplaces have revolutionized the way we predict the movement of traders and investors. With the help of machine learning tools and artificial intelligence, these marketplaces forecast market patterns by analysing trading algorithms and the past performances of investors. Users can also earn rewards by betting on the predictions. These marketplaces operate on blockchain technology and are empowered by smart contracts, which make them highly secure, efficient and transparent. These marketplaces provide a competitive edge to their users and help them grow their revenues. The biggest takeaway about these marketplaces is their robust technology and secure data that provides investors with real-time data analysis and, Hence, unleash their true potential in the crypto market.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.