Centralized Crypto Exchanges Explained: What They Are & How They Work?

Table of Contents

What is a Centralized Crypto Exchange (CEX)?

A centralized crypto exchange is a platform that allows users to buy, sell, and exchange cryptocurrencies securely under the authority of a centralized entity. These platforms act as intermediaries, providing security, high liquidity, user-friendly designs, and high speed to users so they can trade freely in a safe and secure environment.

One of the primary significances of the CEX platforms is that they act as guardians of users’ digital assets. Users can participate in trading activities without worrying about the safety of their assets. CEX platforms allow their users with cold wallet storage, so that they can keep their assets away from the Internet.

The global crypto exchange market is USD 71.35 billion in 2025 and is projected to reach USD 260 billion by 2032. CEX platforms hold a significant share of 87% of the total market value as of this year.

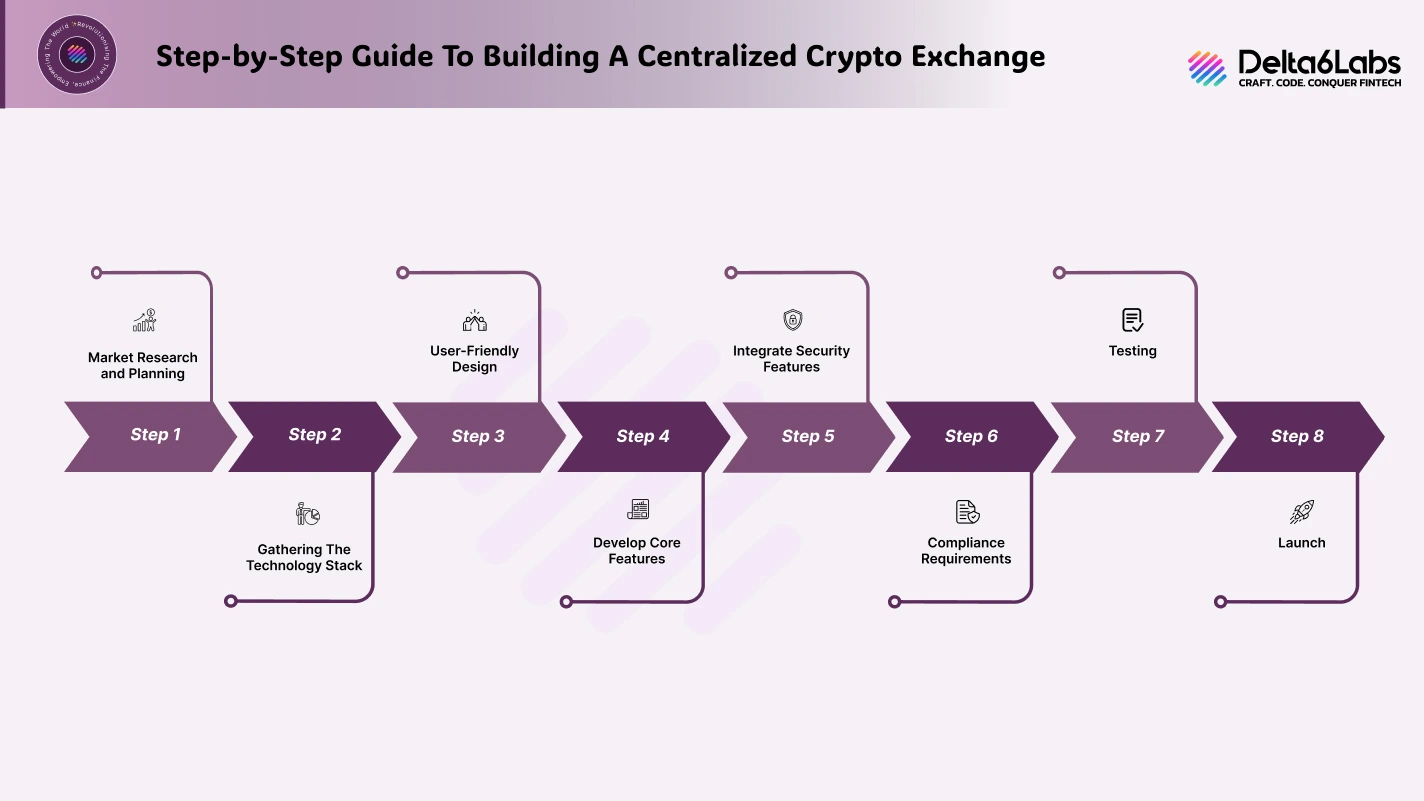

How to Build a Centralized Crypto Exchange (CEX) Platform?

Here is a step-by-step guide to building a centralized crypto exchange:

1) Market Research & Planning

Identify Your Target Audience: Understand users’ preferences, trading habits, and regional regulations. Conduct Competitor Analysis: Examine existing platforms to identify gaps and opportunities. Define Features: Identify core functionalities, including trading pairs, order types, and Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

2) Technology Stack Gathering

Gathering the right technology stack is the next step in the process. Everything, from the programming language to the blockchain platform, is essential to building a secure CEX platform. The most used programming languages are Python, JavaScript, and C++. Another significant part of the tech stack is choosing a robust trading engine.

3) User-friendly Design

The next step in the development process is to create a seamless user experience, which is crucial for attracting and retaining users, especially those new to the cryptocurrency market. Key components of an Excellent UI/UX are intuitive navigation with clear options for deposits, trading, and withdrawals, Advanced charting tools for professional traders, and a mobile-friendly design for trading on the go.

4) Develop Core Features

After finalizing the design, the next step is to develop the core features. Both front-end and back-end development are integral to the platform. Front-end includes UX, whereas implementations of core functionalities are under back-end development. Wallet management, user verification, and order matching engines are developed at this step to facilitate seamless trading.

5) Integrate Security Features

This is the most crucial step in the CEX development process. To provide additional layers of security, features such as multi-factor authentication, advanced data encryption mechanisms, cold storage, DDoS protection, and multi-signature wallets are integrated into the platform.

6) Compliance Requirements

Adhering to compliance and legal requirements is mandatory for building and operating a centralized crypto exchange. Legal and compliance requirements may vary by region. KYC (Know Your Customer) and AML (Anti-Money Laundering) mechanisms enable CEX platforms to align with the guidelines established by regulatory bodies.

7) Testing

Rigorous testing is conducted to identify and rectify bugs in the platform. Scalability is also tested to assess the platform’s efficiency in handling large volumes of trade and a large number of participants.

8) Launch

Once the bugs are identified and corrected, the CEX platform is ready to launch.

Key Features of a Centralized Exchange Platform

1) Intuitive UI/UX Design

An intuitive user interface design is crucial for the success of a centralized exchange. Users should be able to navigate the platform seamlessly. Mobile-friendly design should be prioritized for on-the-go trading. An attractive and user-friendly UX design boosts engagement and retention.

2) Multi-currency Support

Multi-currency Support is a must-have feature in CEX platforms. This allows users to trade in multiple cryptocurrencies, stablecoins, and altcoins, such as Bitcoin, Ethereum, Ripple, Cardano, and Tether. It also helps users onboard with various fiat currencies, including USD, Euros, and many more. Multi-currency support enhances the platform’s appeal among users as it allows them to diversify their portfolios.

3) Admin Dashboard

A centralized exchange should have a robust admin dashboard that allows admins to monitor trading activities in real-time. It also helps admins manage platform fees and user accounts.

4) Advanced Trading Engine

An advanced trading engine is the backbone of a centralized cryptocurrency exchange, as it enables users to buy, sell, and exchange cryptocurrencies seamlessly. A robust trading engine offers low latency, which facilitates real-time trade execution and enhances scalability to manage trading volume spikes.

5) Enhanced Security

Multi-layered security features, such as multi-factor authentication, biometric authentication, DDoS protection, Jailbreak login procedure, HTTPS protection, and secure crypto wallets, are essential in centralized exchanges. These features provide an additional layer of security for the CEX platform, ensuring users’ digital assets remain safe.

6) Regulatory Compliance and KYC/AML Features

A successful Centralized exchange adheres to the regulatory framework and utilizes KYC and AML mechanisms to keep the platform secure from suspicious transaction patterns and terror financing. A regulatory-compliant platform earns the credibility and trust of users.

7) High Liquidity

One of the key benefits of a centralized crypto exchange is that it provides high liquidity. High liquidity reduces slippage, allowing users to trade efficiently in the ever-volatile cryptocurrency market at fair prices.

Disadvantages of a Centralized Crypto Exchange

A CEX platform has the following challenges or disadvantages that need to be addressed:

1) Hacking Risks

Hacker targets centralized crypto exchanges because they hold a large volume of funds due to a vast number of users. There have been incidents where users have faced substantial losses due to an attack on the CEX platform.

2) Privacy Issues

A central entity governs centralized exchanges; users must provide their personal information, account details, and other sensitive data to the central authority, which can be compromised.

3) Dependency on Third Parties

Centralized exchanges are primarily dependent on several third parties for various services, including liquidity aggregators, security features, and custodial services. This dependency on third-party service providers can result in losses to the platform if these service providers fail to provide their services.

4) High Costs

Centralized cryptocurrency exchanges typically charge high platform fees, which can be unaffordable for users. It may lead to low trading activities on the platform and hence bring down profit margins significantly.

5) Market Manipulation

Centralized cryptocurrency exchanges are prone to price manipulation and trade volume manipulation. Due to this manipulation by traders, users may face losses, and the platform’s credibility is compromised.

Top Centralized Exchanges Around The World

1) Zenit World

Zenit World is a centralized cryptocurrency exchange offering a comprehensive suite of crypto services, including spot trading, derivative trading, OTC, staking, and referral programmes. Developed by Delta6Labs, Zenit World is a popular name among crypto traders.

2) Coinbase

With users in over 100 countries and assets worth $328 billion, Coinbase is one of the most popular centralized cryptocurrency exchanges worldwide.

3) Bitget

Founded in 2018, Bitget is a popular crypto exchange committed to transforming the financial sector. With 120 million users worldwide and a daily trading volume of over 20 billion, it is the largest copy trading platform. Born in a bear market, Bitget prioritizes putting users first, focusing on product innovation, and advocating for long-term development with a genuine spirit. The company aims to inspire people to adopt cryptocurrency and enhance their trading experience, one person at a time.

4) Kraken

With advanced security features and custody service, Kraken is one of the most famous and successful centralized exchanges in the world. Kraken offers margin trading and futures trading features to its users, allowing them to earn rewards and maximize their profits.

Bottom Line

Centralized crypto exchanges (CEXs) are leading the way in the digital asset world, creating safe, efficient, and user-friendly spaces for trading cryptocurrencies. Despite risks such as price volatility, security issues, and evolving regulations, millions of traders continue to prefer CEX platforms. This is largely thanks to their high liquidity, sophisticated trading engines, and solid security measures.

Creating a successful CEX isn’t something that happens overnight. It requires careful planning, the right technology, an intuitive user interface, adherence to legal requirements, and strong security protocols. While CEXs offer numerous benefits, such as support for multiple currencies, enhanced trading experiences, and adequate administrative controls, they also face significant challenges, including the threat of hacking, privacy concerns, and reliance on external services. As the cryptocurrency market evolves and changes, centralized exchanges will need to adapt by enhancing their infrastructure, staying compliant with global regulations, and ensuring their users feel secure.

In today’s fast-paced financial landscape, CEXs play a crucial role in making cryptocurrency accessible to a broader audience, connecting traditional finance with new decentralized technologies. To continue thriving, they’ll need to strike a balance between embracing innovation, staying compliant, and maintaining top-notch security.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.