AI-Driven Crypto Trading Software Development: From Idea to Launch

Table of Contents

Key Takeaways

- An automated AI trading system allows you to automatically buy or sell crypto assets for trading.

- Machine learning AI algos will learn historical patterns and adjust to new behaviours in the market conditions, chronicling the changes and analyzing the behavior thus growing to be quite robust to changes in the underlying data.

- Developing AI-based trading software for cryptocurrency is neither time-consuming nor trivial but requires a systematic methodology.

- The predictive accuracy of AI models may achieve a new peak with better quantum computers, and the execution could be ultra-low latency on mobile and IoT devices with the help of the edge computing.

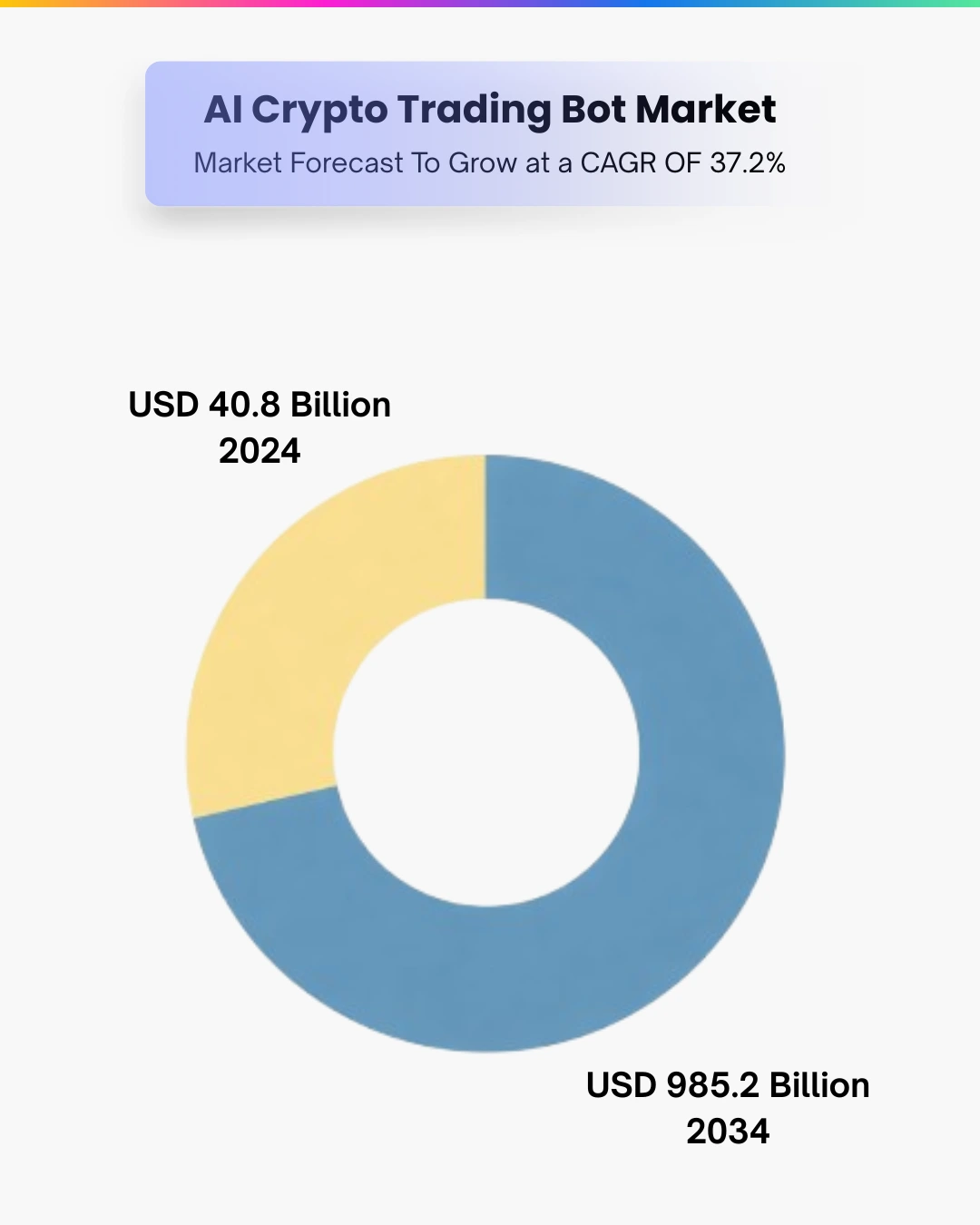

The impact of Artificial Intelligence (AI) is very much visible on various industries, and cryptocurrencies are no exception. The crypto market is active all day, experiences high levels of volatility, and offers thousands of assets to trade, making it a primary candidate for AI integration. Crypto trading is all about speed, making data-informed decisions, and being adaptable. AI software does all of this, and more. It can analyze troves of data, pinpoint winning trading opportunities, and execute trades at lightning speed, all feats unattainable by mere mortals. The global AI crypto trading software bot market valued at USD 40.8 billion in 2024, is expected to grow by 37.2% CAGR to reach market size worth USD 985.2 billion by 2034.

People can’t trade and aren’t able to work for extended periods of time like a computer can. Beyond that, humans are wired with emotions that can cloud their judgement and lead to trading decisions that are more rushed than optimal. This is especially true as trading in the crypto markets can lead to high levels of anxiety. Because of this, being able to leverage automated trading software can offer a significant edge to businesses, hedge funds and small retail traders.

Fortunately, developing a unique trading AI that offers significant competitive advantages is completely realistic. In this blog, we will cover the vast benefits AI activated cryptocurrency trading to helping consumers for the first time. Let’s first take a look at automated trading software.

What Is An Automated AI Trading System?

An automated AI trading system allows you to automatically buy or sell crypto assets for trading. However, it is not a regular bot. AI trading software uses ML, requires AI to digest the market, and makes a decision based on it. It can manage potential market risks related to human limitations, as well as execute trades 24/7.

Why AI Trading Software Matters in the Crypto Market?

Traditional strategies have two problems: it is all manual charting, there is lag in decision making, emotional bias and finally the crypto markets are ‘’sleeping”. This gap is all bridged by AI, for Real-time analysis and execution of trades, the streams of data flowing in from the markets.

Machine learning AI algos will learn historical patterns and adjust to new behaviours in the market conditions, chronicling the changes and analyzing the behavior thus growing to be quite robust to changes in the underlying data. While human traders have a limit on their computing power, AI does not have limits and can supervise millions of markets and currency pairs without missing the next opportunity to profit.

For institutions, AI enables scalability. Simultaneously running thousands of strategies, auto-optimization and execution of trades on-the-fly and across a multitude of exchanges — all on a single platform.

Advantages of Crypto Trading Platforms Using AI

Advent of AI can be beneficial for crypto trading platform in many ways.

Speed and Efficiency

To AI, Speed and efficiency is greater than any human, and in a market where prices can reverse in a matter of seconds, speed of execution is everything. Traders AI platforms have an inherent competitive advantage because they can risk assess, evaluate market signals, and execute trades before managed human traders complete their analysis.

Data-Driven Decision Making

Artificial intelligence algorithms are supernova-delivering terabytes of data points across historical prices from time series feed data, order books, social media sentiment and even blockchain transaction patterns to make predictions beyond the scope of any mere technical indicator.

Emotion-Free Trading

Artificial intelligence takes away that emotional bias that can bring you to a hasty decision making process. AI has the advantage of avoiding human error because it only works on data-backed strategies.

Adaptability

By constantly learning and adapting their response to derived market data, machine learning models can help adjust strategies effortlessly as market conditions change.

Multi-Market Monitoring

It can watch hundreds of crypto assets from centralized and decentralized exchanges, scanning for arbitrage opportunities, trend reversals or breakout patterns with real-time speed.

How to Develop an AI Crypto Trading Software

Developing AI-based trading software for cryptocurrency is neither time-consuming nor trivial but requires a systematic methodology. Here is a breakdown of the flow process:

Define Objective

Plenty of people decide to start typing away but fail to appreciate step one: What is the purpose of your platform? Should the strategy be day, swing, arbitrage, or high-frequency? Is it a tool for internal purposes, a proprietary trading service, or a SaaS platform solution in the offering? The scope definition decides everything starting from the AI models needed to be able to integrations between each other.

Integrate Market Data

The flip side of that coin is that AI systems face the need of very good and actual data of the present time, Which involves connecting to the APIs of major exchanges such as Binance, Bybit, and Coinbase, as well as to DEX APIs through blockchain nodes or aggregators. Depending upon the source you choose, data has to include price feeds, and or order books, trade history and, in some cases, on-chain analytics too.

Choosing the AI Model

Your trading strategy will dictate which AI model you choose:

- Supervised Learning Models: It is another way of predicting future prices based on historical data.

- You can think about Reinforcement Learning Models as discovering optimal actions that should be taken by trial and error.

- News headlines, tweets, and sentiment data are processed by Natural Language Processing (NLP) models to forecast market trends.

Algorithm Design

Once the AI model is established, strategies have to be encoded An AI technique could be used to identify overbought/oversold conditions for a mean reversion strategy, or detect strong breakout trends for a momentum strategy, for example. The strategy design also needs to include risk management rules, including stop-loss limits or position sizing algorithms.

Backtesting

The AI model needs to be checked against historical data to define profitability, drawdown and win rates before going live. Some more advanced platforms provide paper trading, a simulated environment that replicates live market conditions but risks no real funds.

Execution Engine Development

Execution engine: This is responsible for converting signals generated by the AI model into trades in real time. For crypto markets, this consists of working with heavy order types, navigating API rate limits, and making sure failover mechanisms are prepared to go to prevent expensive downtime.

Integrate Security Features

As crypto is volatile, risk controls become the essence. These could be limits on maximum drawdown, limits on exposure per asset or asset class, AI-powered anomaly detection to freeze trading during unusual market conditions, etc. You also need security measures to protect funds: encryption of API keys, enablement of 2-factor authentication (2FA), implementation of multi-signature withdrawals and cold wallet integrations.

User Interface

An intelligent trading platform needs a simple and intuitive UI. Real performance dashboards should be at the tip of the fingers, be able to set risk, switching strategies, on-the-fly. All the three formats — web-based dashboards, desktop applications, and mobile apps — requires UI/UX designers to put on their thinking caps.

Deployment

AI models are not one-and-done; they need to be retrained on a periodic basis in order to remain relevant. After launch, the platform must keep collecting fresh market data, assess AI efficacy, and deploy enhancements. Cloud-based deployment might enable better scaling and updates.

AI in Crypto Trading — The Future

In conclusion, the future of AI with crypto trading appears bright. Even deeper integration of blockchain analytics can be expected, enabling AI to identify whale transactions, network congestion, and DeFi liquidity changes before price action ensues.

The standard will be hybrid AI that combines data analysis of market movement along with sentiment and on-chain metrics. Furthermore, AI DeFi bots smart enough to pursue elaborate yield farming and LP strategies may end up controlling decentralized markets.

The predictive accuracy of AI models may achieve a new peak with better quantum computers, and the execution could be ultra-low latency on mobile and IoT devices with the help of the edge computing.

Delta6Labs’ Approach to Scalable Trading Software Solutions

Known for its technical expertise and use of cutting-edge technology, Delta6Labs harness the power of Artificial Intelligence (AI) in crypto trading by integrating high-performing AI trading software into all the crypto exchange, including white-label crypto exchange development, MT5 CRM development, FX trading platform, etc that provides a competitive edge to the institutional investors and individuals.

Conclusion

Crypto AI trading software is the future of innovation in fintech. When the computational prowess of AI meets the fast-paced, decentralized landscape of crypto, it opens up a new world of precision, speed, and profitability that manual trading cannot compete with, both for traders and institutions. In order to gain an edge in the market, Delta6Labs is making AI-based crypto trading software.

But achieving that success needs thoughtful preparation, solid data infrastructure, enterprise-level security, and continuous refinement. The potential payoffs for people willing to wait and build their own platforms powered by AI is enormous, not only in profits, but in retaining a competitive edge in one of the fastest moving markets in the world.

Frequently Asked Questions

Real-time data feeds from multiple exchanges

AI-based trade signal generation

Risk management tools like stop-loss and take-profit settings

Portfolio tracking and performance analytics

High-grade security measures, including API key encryption and multi-signature withdrawals

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.