Pi Network: In-Depth Analysis and Market Insights

Table of Contents

The Pi network and Pi token stand out among multiple networks and tokens. When the Pi network was launched in 2019, crypto enthusiasts were curious about the different consensus mechanisms used for Pi mining. Unlike Bitcoin, which requires a proof-of-work mechanism for validation, the Pi network operates on the stellar consensus protocol (SCP).

The Pi network was created in 2019 by two Standford graduates, Dr Nicolas Kokkalis and Dr Chengdiao Fan. They started the project with a vision of making digital currency accessible and open to everyone, including those without knowledge of cryptocurrency. They turned their vision into reality by making the Pi network accessible to everyone through mobile phones and started the unique approach of mobile-based mining and decentralized growth module.

What is the Pi Network?

The Pi network is a blockchain-based ecosystem that allows users to mine Pi coins using mobile devices. It does not require the miner to do heavy computations using hardware devices like GPUs. The sole purpose of enabling mining through smartphones was to foster financial inclusion, and the Pi network has achieved that to an extent.

The Pi network operates on the Stellar Consensus Protocol (SCP), a distinctive approach to mining cryptocurrencies. One key feature of the SCP mechanism is that it consumes less energy than traditional methods like Proof of Work (PoW) and Proof of Stake (PoS).

Decoding Stellar Consensus Protocol (SCP)

Stellar Consensus Protocol is an algorithm that helps users in a blockchain network validate a transaction. SCP is a Proof of Agreement (PoA) mechanism in which transactions are validated and added to the blockchain network if agreed upon by nodes. Anyone can participate as a node, but it has to identify itself to other nodes so that they can decide whether to make it a part of the quorum. Quorum set and Quorum slices are two integral terms used in the SCP. A quorum set is a group of nodes present in the network, whereas a quorum slice is a subset of a quorum set formed by choosing a few trusted nodes from the original quorum set.

In SCP, each node is responsible for its own set and slice, and this method is derived from the famous Federated Byzantine Agreement, a consensus mechanism created to reach an agreement among several distributed nodes in a network. The SCP mechanism consumes less energy than other traditional consensus mechanisms like the PoW because a selected number of nodes can participate in mining, and the number of nodes required to validate the transactions is also lower because the node selects its quorum slice itself.

What is a Pi token?

A Pi token is a crypto coin mined on the Pi network using the stellar consensus mechanism. It is the native coin of the Pi network ecosystem. Users can earn Pi coins as a reward for referrals, enlarging their trusted circles and performing daily check-ins on a mobile application. Pi coins can be used to buy goods and services on the platform, where they are accepted as a mode of payment.

The maximum supply of Pi is limited to 100 billion tokens, with a distribution split of 80% for the community and 20% for the Pi Core team. As of now, the total market cap of the Pi token is $8.02 billion, and the circulating supply is $6 billion (dynamic statistics). The prices of Pi tokens have fluctuated a lot since it launched. All the major exchanges have listed the Pi tokens, and at platforms like CoinMarketCap, the Pi token has been ranked between the range of 15-18, which keeps changing with time.

Benefits of the Pi Network and Token

Accessibility

The Pi network’s sole target was to make cryptocurrency mining accessible for everyone, including people who are less tech-savvy and do not have hardware like GPU. It has undoubtedly achieved that target. Pi tokens can be mined with mobile-based devices, making them easily accessible to users from different sections of society.

Less Investment

In Bitcoin mining, advanced hardware devices are required to solve mathematical equations to validate the transactions. These hardware devices are very expensive, and the total cost of Bitcoin mining is very high. Pi network does not require such hardware devices because the validation process is more straightforward. Hence, the investment is low.

Eco-friendly

The Pi network operates on the Stellar Consensus Protocol (SCP) mechanism for validating transactions that add new blocks to the network. The SCP mechanism involves a quorum set and quorum slices, which consist of groups of nodes. The Pi network enables nodes to establish a group of trusted nodes for transaction validation. This approach reduces the number of participants and significantly lowers energy consumption. The Pi token is regarded as an eco-friendly blockchain compared to Bitcoin.

Simple User Experience

One of the biggest problems with crypto mining is requiring advanced technical knowledge. The Pi network functions like another mobile application that allows people to mine crypto coins by daily check-ins without consuming excessive data. The Pi application offers an intuitive interface and a simple user experience that helps users navigate seamlessly.

Market Insights on Pi Tokens

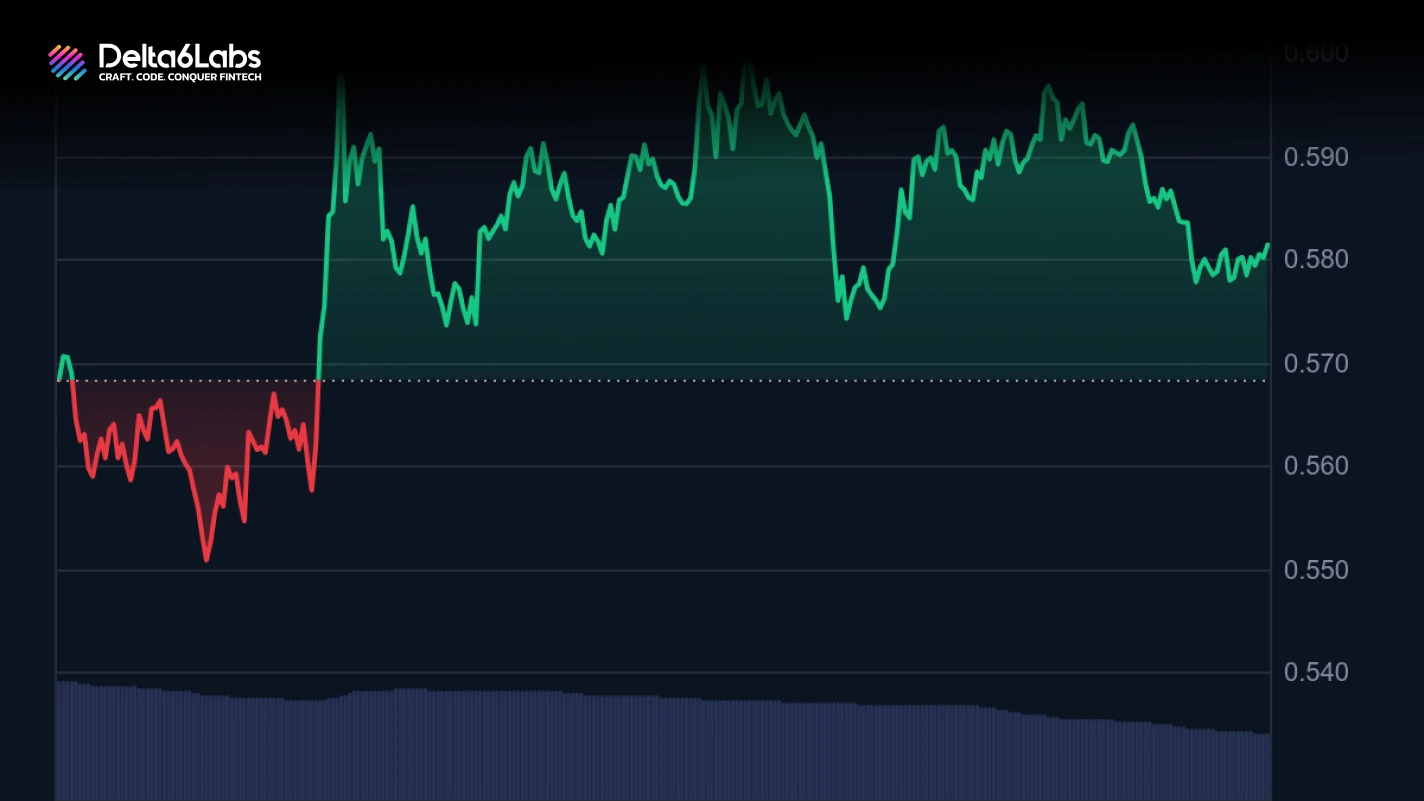

Pi coins launched for trading in February 2025, and since then, their price has experienced significant fluctuations. The Pi coin reached an all-time high of $2.98 on February 22, 2025, and an all-time low of $0.61 on February 25. It has since undergone considerable price volatility, yet it remains ranked between 15 and 18 on the CoinMarketCap platform. Although the Pi network is facing turbulence and its price has dipped below $1.5, trade experts are optimistic about the growth and potential of the Pi coin. Irrespective of the dip in price, investors are still hopeful that Pi prices will rebound and reclaim their all-time high.

Future of the Pi tokens

In recent events, KYC verification was made compulsory for the Pi users, and the accounts of those who failed to do so were fortified. Due to this, the price of Pi coins dipped even more than the usual trend. Experts are seeing this move by Pi network owners as a “good move” in the long run, but the investors are calling it a fullish attempt that has caused uncertainty in the market.

Despite the continuous dip in the price of Pi coins, the eco-friendly token is picking up steam among investors and trade pundits. Many marketplaces worldwide, especially in China, are accepting pi tokens as a mode of payment. Investors are also looking at exchange listings of Pi tokens. If the Pi token gets listed on the Binance exchange, then the dust about the stability of Pi tokens will certainly be cleared. Users are expecting it to move towards the $1.5 mark, so the chances of it moving towards $2 seem more realistic.

Conclusion

The Pi Network has introduced a groundbreaking approach to cryptocurrency mining, making it accessible to a broader audience through mobile devices. By utilising the Stellar Consensus Protocol (SCP), Pi offers a more energy-efficient alternative to traditional blockchain systems like Bitcoin, which rely on the energy-intensive Proof of Work (PoW) mechanism. This eco-friendly approach has gained significant attention, positioning Pi as a more sustainable option in the rapidly expanding cryptocurrency market.

Despite the excitement surrounding its accessibility and low investment requirements, the Pi Network faces several challenges, including price volatility and uncertainty due to the recent implementation of mandatory KYC (Know Your Customer) verification. These factors have contributed to fluctuations in the price of the Pi token, leading to some scepticism among investors. Nevertheless, many remain optimistic about the token’s future, especially with its increasing acceptance in various markets and the potential for listings on major exchanges.

The success of the Pi Network will largely depend on how it addresses these challenges, builds its ecosystem, and maintains its community-driven approach. While the road ahead remains uncertain, the unique combination of inclusivity, eco-friendliness, and mobile mining provides the Pi Network with a strong foundation for growth within the evolving cryptocurrency landscape.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.