Decentralized Finance (DeFi): Benefits, Challenges and Use Cases

Table of Contents

Decentralized finance is a permission-less exchange of cryptocurrencies directly using blockchain technology without the need for a third party. It is a peer-to-peer mechanism for performing transactions, excluding intermediaries and reducing multiple platform fees. It is a highly volatile market with huge revenue generation potential.

The Decentralized Finance (DeFi) Market was valued at USD 14.35 billion in 2023, and market statistics firms expect it to grow at a CAGR of 46.8% between 2024 and 2032.

What is Decentralized Finance (DeFi) ?

DeFi is an emerging technology in cryptocurrency exchange and financial services. The most intriguing part about DeFi is the absence of any central authority. DeFi enables individual-to-individual transactions, which are intended to bring more transparency into the transactions and empower the individuals rather than allowing a central authority to control the whole system.

DeFi model enables a peer-to-peer approach among individuals to buy, sell or exchange cryptocurrency. In the absence of any third party, the transactions are faster, which makes it convenient for the users. The emergence of DeFi as a potential way of exchanging digital assets is very significant to the global crypto market.

How does DeFi Work?

A decentralized finance system works through P2P financial networks, removing the intermediaries like banks or other financial service providers. DeFi works on blockchain technology eliminating the need for these intermediaries, because these financial providers charge customers and businesses for their services.

Blockchain

A blockchain is a secured form of database in which information is saved in a chain of blocks. Once the data is stored in one block, it cannot be changed without changing the data in other blocks, which makes it more secure.

Decentralized Finance Wallets and Smart Contracts

Other than the blockchain technology, the decentralized finance system uses DeFi wallets that can send information to the blockchain. To use these wallets, private keys are issued, which work as passwords. These private keys enable virtual tokens with a specific value. These virtual tokens are transferrable in nature and can be transferred directly through a DeFi wallet. These tokens are ultra-secure, and the irreversible nature of blockchain technology is a cherry on top.

Smart contracts are code-based automatic contracts that are designed to help traders in buying, selling, or exchanging cryptocurrency. Blockchain uses these smart contracts to perform trading without any human support.

Benefits of Decentralized Finance (DeFi)

The foremost question that people ask before initiating anything is, what are the benefits? The beneficial features of Decentralized finance are

Transparency

The decentralized financial systems use blockchain technology, which enables peer-to-peer exchange of financial services. Further, blockchain technology empowers virtual tokens secured by private keys, to perform financial exchange without any human support. All these features make decentralized finance system, a transparent pinnacle in the crypto community.

Accessibility

The foremost benefit of using decentralized finance is, that it is easily accessible from any corner of the world. People can exchange digital assets from different parts of the globe without worrying about security or availability.

Security

DeFi, generally works through blockchain technology which is among the most secure modes of data building. Blockchain technology is more resistant to cyber-attacks and frauds as compared to centralized finance systems

Less Fees

Platform fees for decentralized finance systems is less than the traditional finance system because, in the absence of a third party or intermediaries, the fees is automatically less than centralized finance systems.

Pseudonymous

DeFi perform transactions through smart contracts, which do not need any human support. As private keys are provided against the virtual tokens, there is no need to validate the user identity. only the authorized person can perform any financial activity in a decentralized finance system

Faster

The complete process of DeFi is automated through smart contracts and the intermediaries are absent. This make DeFi faster than the traditional systems of financial exchange.

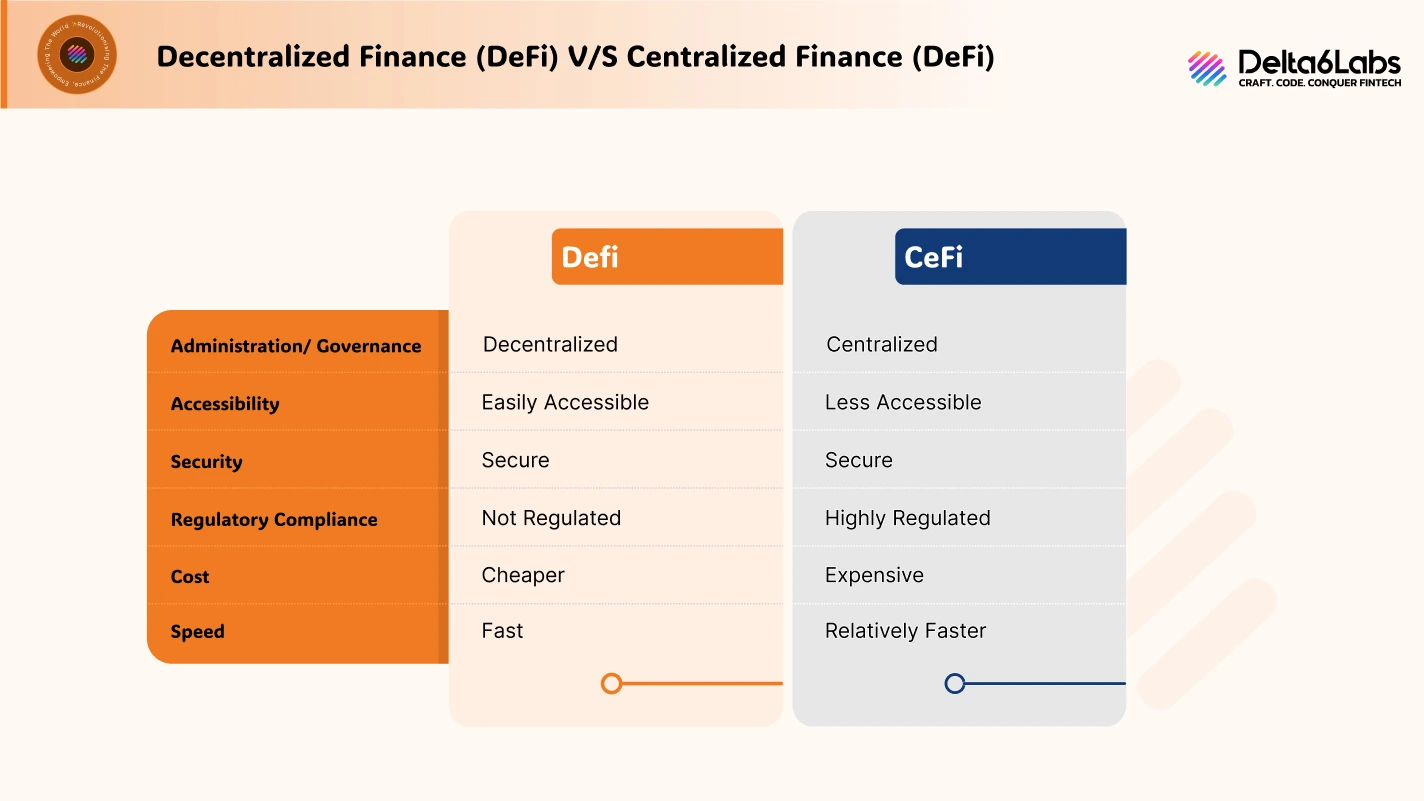

DeFi vs CeFi

The crypto market follows either of the centralized or the decentralized finance system to perform exchange of digital assets. To understand which one of these is more feasible and convenient for the users, we must compare their respective features.

Administration

Authority plays an important role in the functioning of any platform. In the case of CeFi, the authority lies within the ambit of central entities, whereas in the case of DeFi, the individuals are solely responsible for all the necessary functions

Accessibility

DeFi is accessible to everyone who has access to the internet, irrespective of the geographical location. CeFi, on the other hand, has restrictions based on the geographical location, and other criteria also need to be met before providing access.

Security

Both centralized and decentralized systems are secure, but they also have some drawbacks. DeFi relies on smart contracts which have their own vulnerabilities, whereas CeFi works on a security system installed by the central authority, which makes it secure. CeFi faces security threats due to the presence of intermediaries and third parties

Regulatory Compliance

DeFi do not have any specific set of rules and regulations. Individuals are the power centres. CeFi adheres to the regulatory framework and rules as suggested by the central authority

Cost

DeFi charges less platform fees as compared to the centralized system because CeFi has to pay its intermediaries and third parties, and it recovers the amount from its users. There are no intermediaries in the DeFi.

Drawbacks and Problems of Decentralized Finance (DeFi)

Hacking Threat

DeFi faces security threats from hackers because of faulty programming by the system developers and because of the absence of regulatory compliance

Irreversible Process

In the blockchain system, Once the data is stored in the block it can be changed without changing the data in other blocks as well. Similarly, If the funds are transferred to the wrong address or across any wrong network then the transferred amount is irretrievable.

Complicated Technology

The blockchain technology is a complicated process and it may be difficult to handle for a person with less technical knowledge. Also, dealing with smart contracts and DeFi wallets can be tough for a non-tech-savvy user.

Shared Responsibility

Centralized finance systems offer insurance and other consumer protection mechanisms to protect customers from any potential risks. DeFi doesn’t have any such mechanism, the users are solely responsible for any loss they occurs due to cyber fraud or any other technical error.

Use Cases of DeFi

DeFi has proved its worth and has become a top finance service provider in different sectors such as:

Lending and Borrowing protocols

DeFi allows users to borrow assets without the need of intermediaries. Users can put smart contracts as collateral and borrow loans.

Decentralized Exchanges

The largest share of the total market value of the decentralized finance system is generated through the decentralized exchanges. These exchanges provide a platform to traders for buying and selling cryptocurrency from any part of the world.

Some of the famous decentralized exchanges are Binance, Bybit, and BitDelta. Delta6labs is a software development company that develops such crypto exchange platforms

Yield Farming

Users can earn rewards by using the staking feature of decentralized finance platforms. users can put their digital assets at stake or lend them and yield returns

Non-fungible Tokens

NFTs have emerged as financial assets with unique features. They are bridging the gap between blockchain and traditional assets.

Insurance

Crypto trading companies have started to create decentralized loans and insurances on blockchain technology using smart contracts as collateral. Anthem, one of the top health insurance companies in the USA has started to store using blockchain technology.

Conclusion

Decentralized finance has emerged as a secure, fast, and easily accessible method of exchanging financial services. DeFi uses blockchain technology, which integrates smart contracts that allow users to trade in cryptocurrency. DeFi is still in its adolescence, and that is the reason there are no compliance and legal frameworks. DeFi works on blockchain technology, making the transactions irreversible, which makes it a problem for new users who do not have technical knowledge. It is also prone to hacking and smart contract exploitation.

Although the crypto market is highly volatile in nature, one can’t overlook its high revenue-generating potential. In the crypto market, DeFi has emerged as a game changer. And as per the market trends, it has a bright future ahead.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.