Cybersecurity in FinTech: Why It Matters More Than Ever in 2026

Table of Contents

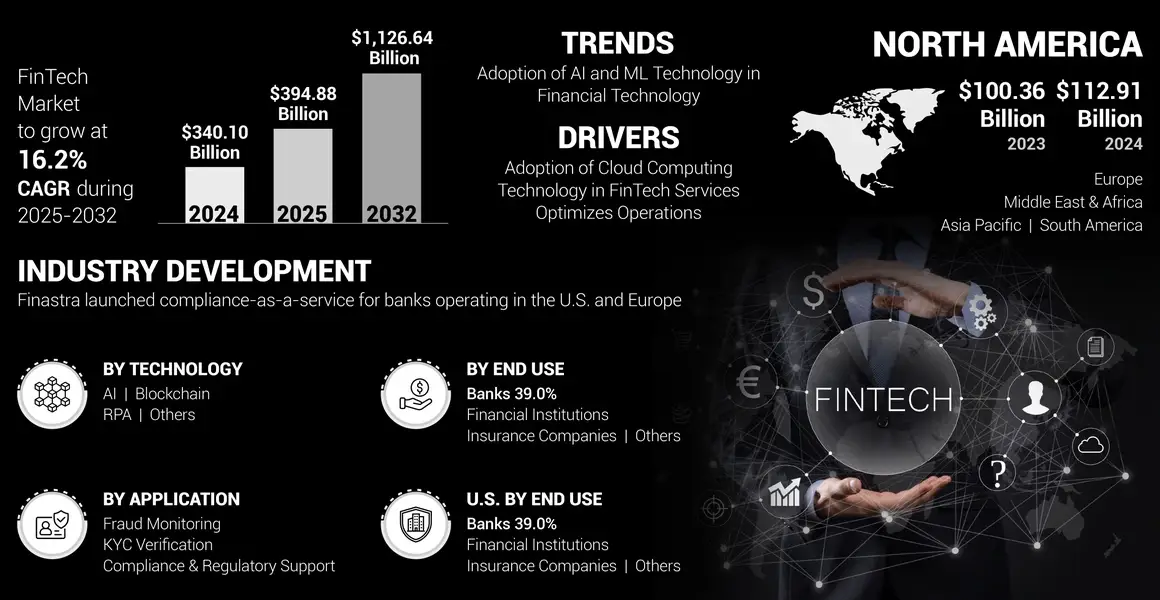

With great power comes great responsibility, they say. In the fintech world, we add one more thing to that; with great popularity comes big security issues. According to reports, the FinTech industry has a market size of more than $390 billion to date, and it is projected to reach $1,200 billion by 2032. In a sector with such a high level of capital flow, security risks are also increasing. According to another report, cybercrime costs are projected to reach $10 trillion annually by the end of this year. In this blog, we will discuss the importance of cybersecurity in fintech business.

Image Source: FortuneBusinessInsights

The Role of Cybersecurity in Today’s FinTech Landscape

There are several reasons why robust security has become a necessity for companies. Such reasons are:

Building Customer Trust

If cybercriminals attack a Fintech platform, they can access the personal data of customers, potentially resulting in significant losses for them, which will lead to a breach of trust between the customer and the service provider. To build customer trust, companies need to prioritize cybersecurity.

Managing Third-party Integrations

Multiple third parties, such as vendors and banks, are connected to companies, which may provide them access to sensitive information. They can also gain access to customers’ profiles and potentially leak them to cybercriminals, resulting in significant losses for the firm and its users.

Social Engineering

There are some scams, such as the honeypot scam and Crocodilus malware, that leverage human emotions to influence decision-making and gain access to login credentials and other sensitive information. These are the most prominent threats to cybersecurity.

Cloud Misconfigurations

Most information is stored in the cloud, which serves as the backbone of the FinTech industry. If the cloud server of any business is compromised, the losses can be substantial.

Managing Evolving Cyber Threats

Phishing and Advanced Persistent Threats (APTs) are among the most prevalent cybersecurity threats in the Fintech sector. It is extremely vital to tackle these evolving issues.

Best Practices to Avoid Cybersecurity Attacks

Multi-factor Authentication (MFA)

The foremost thing that one should do to prevent cybersecurity attacks is to enable multi-factor authentication in all accounts to stop unauthorized access. Preventing unauthorized access to customers’ accounts can help protect the platform from scammers and hackers who may cause damage.

Regular Security Audits

It is mandatory to conduct regular security audits to identify potential issues, loopholes, and vulnerabilities in the system, so that they can be identified and rectified before any mishap takes place.

AI-powered Fraud Detection Tool

All companies should integrate AI-driven fraud detection tools to provide an extra layer of security. These tools help companies detect cyber fraud and monitor potential threats in real time. ML tools are also used to detect suspicious activities and provide real-time information regarding cyber threats.

Cybersecurity Awareness

Every FinTech company must educate and train its employees on implementing best practices to enhance cybersecurity. Companies should also run awareness campaigns to inform users about cybersecurity threats and ways to prevent them. This will help prevent social engineering and phishing attacks.

Encryption

Fintech companies should use robust encryption mechanisms to encrypt customers’ sensitive information. Encryption tools can prevent unauthorized people from accessing the information and keep the data secure. Additionally, inbound and outbound traffic should be decrypted to identify hidden threats.

Zero-trust Architecture

One of the most effective ways to prevent cybersecurity attacks is to implement zero-trust architecture across all financial technology (FinTech) companies. It limits access only to the necessary data and ensures that verified and authorized users can access sensitive information.

Software Security Patches

It is beneficial for companies to regularly update their software and apply security patches to detect potential threats and prevent breaches.

The Delta6Labs Era

Delta6Labs can help enterprises, businesses, and fintech companies by providing innovative and robust security solutions. It also integrates multi-layered security features into all its crypto exchanges and wallets. Cybersecurity is Delta6Labs’ top priority, and with continuous innovation in the field, it has become a trusted name in the FinTech sector.

Conclusion

Cybersecurity is the most vital aspect of the Fintech industry, as this sector is the most promising in the global economic landscape. Fintech companies are vulnerable to cyberattacks because their data is often stored in the cloud, and they have users with digital footprints that scammers can exploit. Since the customers are humans, there is always a possibility of social engineering attacks and phishing.

These attacks can be prevented by implementing some practices and integrating some security features in the companies. Raising awareness about cybersecurity is the need of the hour to keep customers’ data secure and build trust among users.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.