Centralized vs Decentralized Exchanges: A Guide to Choose the Right Crypto Exchange

Table of Contents

Both have different features and are suited for a wide range of traders, including beginners and seasoned traders. From regulatory compliance to advanced trading options, these exchanges differ from each other in many ways. However, they are contributing to the global economy significantly. The global market size of the cryptocurrency exchange market is valued at $63.38 billion in 2025, and it is expected to reach $150.1 billion in 2029. In this blog, we will explore these two types of exchanges, their characteristics, and their distinctions.

What Is A Centralized Crypto Exchange (CEX)?

A centralized crypto exchange is a platform that empowers traders to buy, sell, and exchange cryptocurrencies securely under the governance of a centralized authority. CEX platforms serve as intermediaries, providing security, high liquidity, user-friendly interfaces, and high speed to users, allowing them to trade hassle-free, in a safe and secure ecosystem.

One of the major significances of the CEX platforms is that they act as guardians of users’ digital assets. Users can participate in trading activities without worrying about the safety of their assets. Some CEX platforms also provide insurance services to traders, in case their crypto assets are stolen in a cyberattack. CEX platforms enable their users to store assets in cold wallets, keeping them offline and out of the Internet.

CEX platforms hold a significant 87% share of the total market value as of this year.

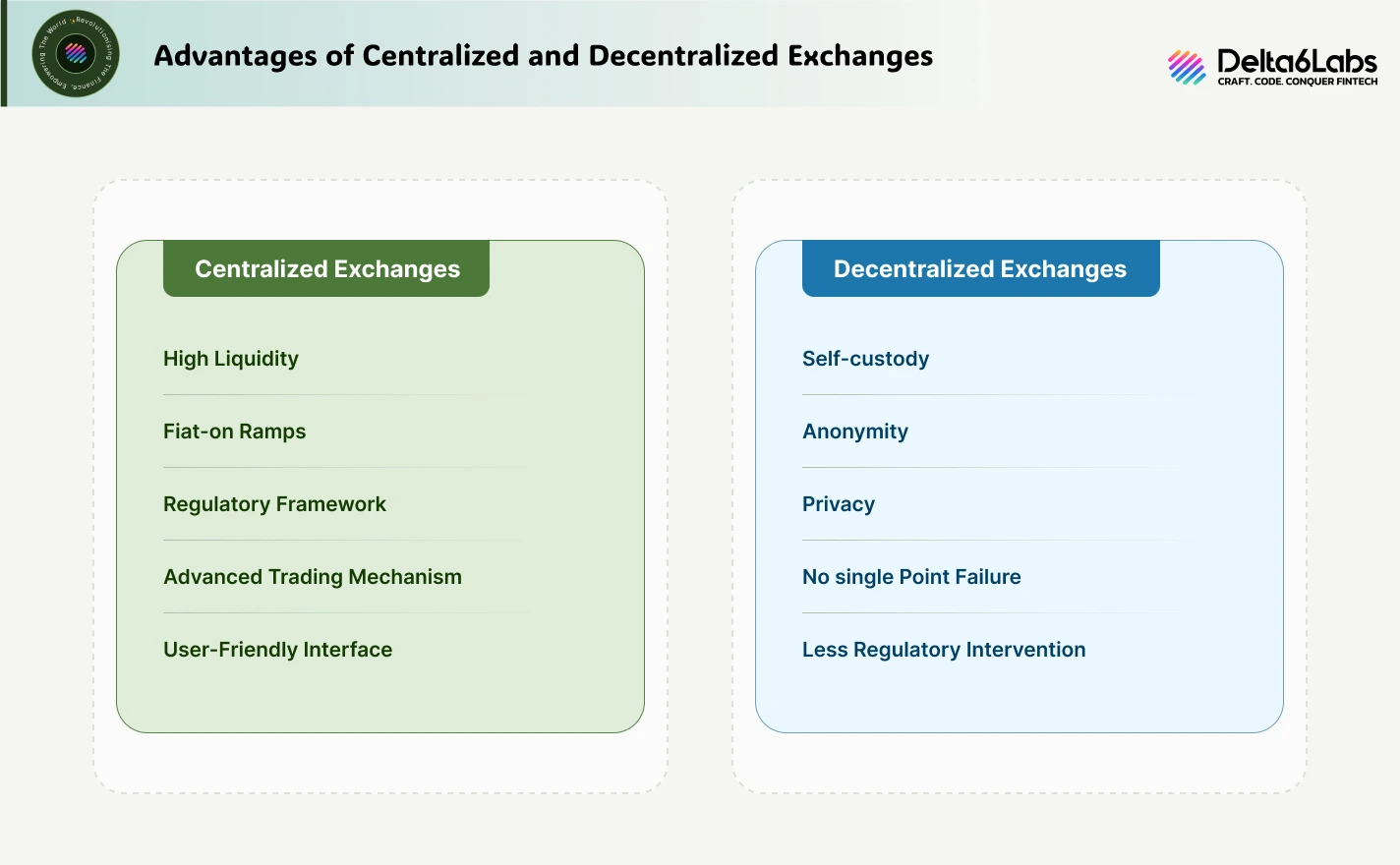

Advantages of Centralized Exchanges

High Liquidity

Centralized crypto exchanges provide one of the biggest advantages in the cryptocurrency trading market, and that is high liquidity. It further reduces slippage and allows traders to execute trades efficiently without any significant change in prices.

Fiat-on Ramps

Various crypto exchanges allow direct purchase of cryptocurrencies through fiat money, such as USD, EUR, GBP, etc. It saves users from putting extra efforts in converting fiat into crypto for executing a trade.

Regulatory Framework

Mostly, CEX platforms function in adherence to the global regulatory framework drafted by the FATF, FIU, and regional agencies. It helps them build credibility and trust among users, also saves them from penalties, and even permanent shutdowns.

Advanced Trading Mechanism

CEX platforms offer multiple advanced trading mechanisms, such as spot trading, derivative trading, margin trading, futures trading, token swaps, trading bots, a user dashboard, and real-time charts.

User-friendly Interface

An intuitive user interface design is crucial for the success of a centralized exchange. Traders should be able to navigate the platform seamlessly. Mobile-friendly design should be prioritized for on-the-go trading. An attractive and user-friendly UX design boosts engagement and retention.

What Is A Decentralized Exchange?

Decentralized crypto exchanges, or popularly known as DEX, are platforms that allow traders to buy, sell, and exchange cryptocurrencies without any central authority to oversee operations. These are peer-to-peer trading platforms that allow traders to exchange crypto assets directly with one another. DEX platforms leverage smart contracts and blockchain technology to ensure that the trading process is secure and transparent.

In recent times, DEX platforms are becoming extremely popular because the demand for user privacy, anonymity, and ownership is at an all-time high. Some famous DEX platforms are Uniswap, PancakeSwap, 1inch Network, and SushiSwap.

Advantages of Decentralized Exchanges

Self-custody

One of the best features of decentralized exchanges is that they provide complete ownership and custody of assets and operations to traders, with no central authority to oversee them.

Anonymity

DEX platforms primarily do not conduct identity verifications, such as KYC and AML. Additionally, the trade is executed directly between users, with no intermediaries involved. This brings anonymity and attracts users who do not want to reveal their identity.

Privacy

All the transactions are stored on a blockchain network, and smart contracts are integrated to execute trades when the predetermined conditions are met. It protects the anonymity of traders and enhances security.

No Single Point Failure

There is no single point of failure in decentralized exchanges, which is a possibility in CEX platforms. As there is no central authority, and trades are executed under a peer-to-peer mechanism, the chances of a single point of failure are eliminated.

Less Regulatory Intervention

DEX platforms are beneficial for traders who want to trade across multiple countries, as these exchanges often do not adhere to the regulatory framework. It enhances accessibility and attracts global users.

CEX vs DEX: Which One is Better?

There are certain aspects, depending on which, we can judge which one is better. But that would not prove one’s superiority over another. It will only help us determine which exchange is more suitable for a trader based on their requirements.

Risk Management

If we discuss the risk management aspect, CEX platforms have access to users’ wallets, which makes them vulnerable to hacks. However, DEX platforms enable users to have complete control over their assets, and the security of private keys is in their hands, rather than with the exchange.

Trader Type

CEXs are best suited for new traders because it has a simple user interface and no technical complexities. In contrast, DEX platforms require smart contract interaction for trading, which is more suitable for seasoned traders.

Liquidity

CEX platforms offer high liquidity that helps traders trade efficiently in the volatile crypto market, without much fluctuation in prices. On the other hand, DEX platforms offer low liquidity because they are dependent on users to provide liquidity through smart contracts, which can lead to slippage and less favorable prices.

Fee Structure

CEX platforms generally charge a fee ranging from 0.1% to 0.5%, and also impose deposit and withdrawal fees. Whereas DEX platforms usually have a lower fee structure than CEX platforms, they can charge additional ‘Gas fees’ for blockchain transactions, which may vary depending on network congestion.

Take Away

Both CEX and DEX platforms have multiple advantages and a few limitations. It is tough to say which one is better between the two, because it entirely depends on the users’ requirements. Although a comparative analysis can be conducted, it is only to help traders choose exchanges based on their needs, not to determine the superiority of one over another.

The number of both CEX and DEX exchanges is increasing, indicating a rise in demand for both in the market. It is good news for the decentralized economy and the crypto world. Multiple exchanges offer both centralized and decentralized features to attract a wide range of traders.

If you are also willing to build a platform that has features of both, then connect with Delta6Labs.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.