How are AML and KYC Compliances Strengthening the Crypto Exchanges?

Table of Contents

The Financial Action Task Force (FATF), the Financial Intelligence Unit (FIU), and other regulatory bodies worldwide are working to establish regulations that mitigate the risk of terrorist financing. In this article, we will explore the role of AML and KYC in strengthening the crypto industry and reducing illegal activities, and identifying illicit users.

What is Anti-money laundering (AML)?

Anti-money laundering refers to a set of rules, laws, and policies to prevent unlawful activities and terrorist financing. The Financial Action Task Force (FATF) has established anti-money laundering (AML) rules for the cryptocurrency industry, and regional regulatory authorities are legally enforcing this framework to ensure that crypto service providers adhere to them. This helps regulatory agencies to identify suspicious trade patterns and prevent them before any substantial loss happens.

Understanding Know Your Customer (KYC)?

The KYC process is a mechanism used to identify and verify customers before onboarding them to a crypto trading platform or other services. KYC process includes residential proof, ID cards, Voter IDs, and biometric verification. Proof of identity (POI) and proof of Address (POA) are two key components of the Know Your Customer (KYC) mechanism. Each country has its own set of requirements for document verification to adhere to the Know Your Customer (KYC) process.

AML in Crypto Exchanges and FATF’s Travel Rule

How does AML secure the crypto exchanges?

To answer this question, it is vital to understand the mechanism of AML in cryptocurrency exchanges.

The Financial Action Task Force (FATF) is the primary body that establishes rules for Anti-Money Laundering (AML) in the crypto space. It started framing rules for decentralized currencies in 2014, and since then, the framework has been continuously evolving. Now, Virtual Asset Service Providers (VASPs), including crypto trading platforms, stablecoin issuers, and NFT marketplaces, function under the framework of the FATF.

KYC in Crypto Exchanges

Cryptocurrency KYC (Know Your Customer) refers to the identity verification processes that virtual asset service providers (VASPs) are required by law to follow. These KYC procedures are essential because they enable law enforcement to link pseudonymous cryptocurrency addresses to real-world individuals when those addresses are involved in criminal activities.

In traditional finance, valid credentials typically include verification of an ID card, facial recognition, and biometric authentication. Additionally, many banks require proof of address, such as a recent utility bill or bank statement.

In the cryptocurrency sector, KYC requirements are less standardized. Most crypto exchanges ask new customers to provide their full legal name, a government-issued ID, and current address information during the onboarding process. However, these requirements can differ based on the exchange’s location and the services it offers.

Crypto Travel Rule in India

The crypto travel rule is a set of guidelines for Virtual Asset Service Providers (VASPs) to send or receive personal information from users, enabling them to identify illicit users and suspicious trading patterns. As per the AML/CFT guidelines by the FATF and FIU, service providers can collect personal information related to users, such as domicile, bank proofs, voter IDs, and any other relevant documents. The SPs can fetch data from both parties, the beneficiaries and the originator.

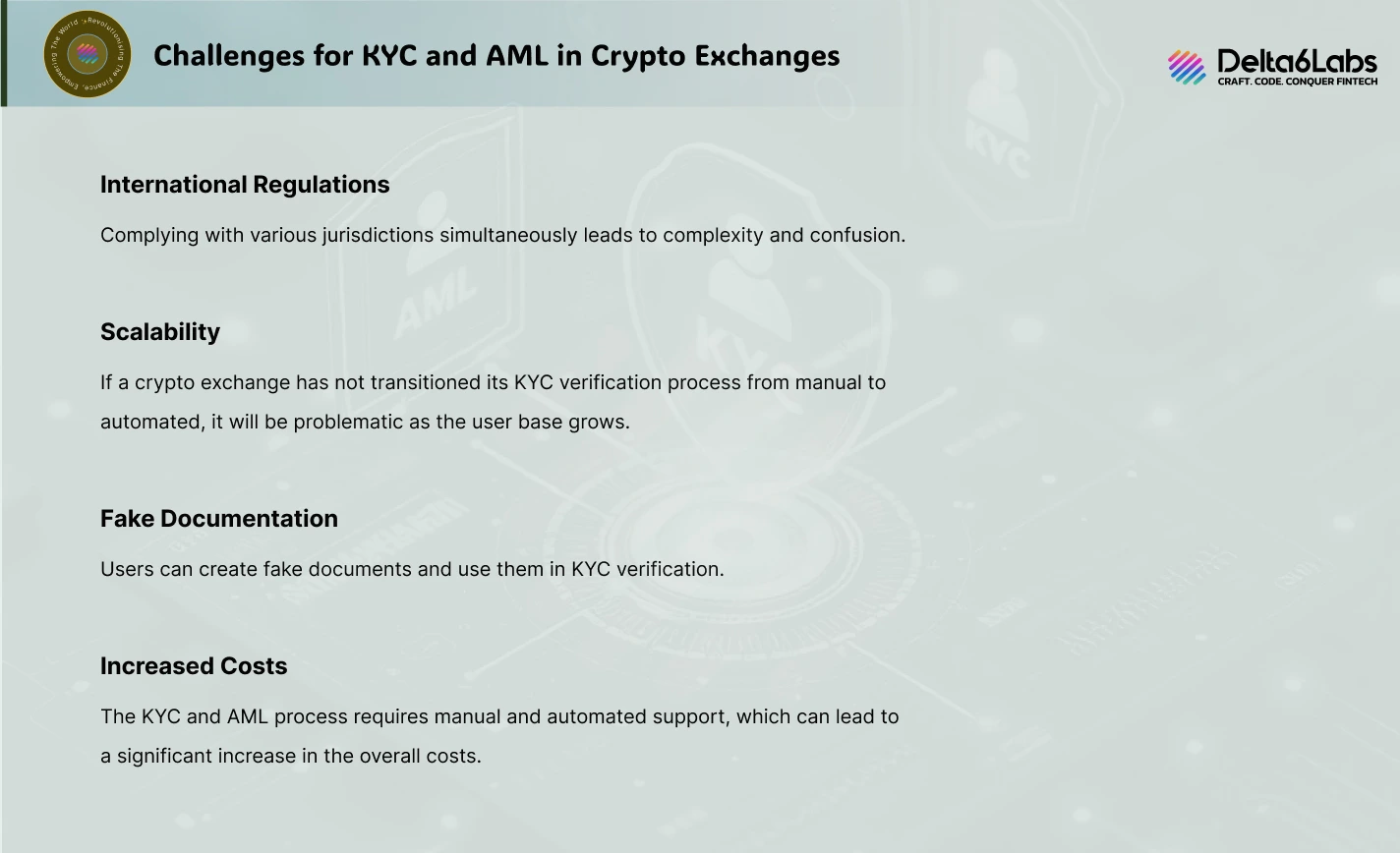

Challenges for KYC and AML in Crypto Exchanges

Here are a few challenges that crypto exchanges face in KYC and AML:

International Regulations

Crypto exchanges function in multiple countries, and the regulatory framework is different for each country, adhering to which can be a mammoth task. Complying with various jurisdictions simultaneously leads to complexity and confusion.

Scalability

If a crypto exchange has not transitioned its KYC verification process from manual to automated, it will be problematic as the user base grows.

Fake Documentation

One of the primary challenges in KYC verification is the use of fake documentation. Users can create fake documents and use them in KYC verification.

Increased Costs

The KYC and AML process requires manual and automated support, which can lead to a significant increase in the overall costs.

Bottom Lines

The implementation of robust Anti-Money Laundering (AML) and Know Your Customer (KYC) practices is essential for enhancing the integrity and security of the crypto industry. These measures not only help regulatory bodies track suspicious activities but also protect legitimate users by fostering a more trustworthy environment in which cryptocurrencies can be utilized.

However, challenges such as differing international regulations, scalability issues, and the prevalence of fake documentation pose significant hurdles. Addressing these challenges will require concerted efforts from regulatory authorities, crypto service providers, and the broader financial ecosystem to create a safer and more compliant landscape for digital currencies.

Frequently Asked Questions

Disclaimer:

The information on this blog is for knowledge purposes only. The content provided is subject to updates, completion, verification, and amendments, which may result in significant changes.

Nothing in this blog is intended to serve as legal, tax, securities, or investment advice of any investment or a solicitation for any product or service.